Introduction

If you’re struggling to manage your finances and feeling overwhelmed by your expenses, you’re not alone. Many of us find it challenging to keep track of our income, spending, and savings, leading to stress and uncertainty about our financial future. I understand your skepticism about online products claiming to solve these issues, especially in the realm of budgeting and finance. That’s why I want to introduce you to the Personal Budget Planner. This tool promises to help you take control of your finances with a structured approach to budgeting. In this review, I’ll provide an honest assessment based on my experience and insights into whether this product could genuinely help you.

What is Personal Budget Planner?

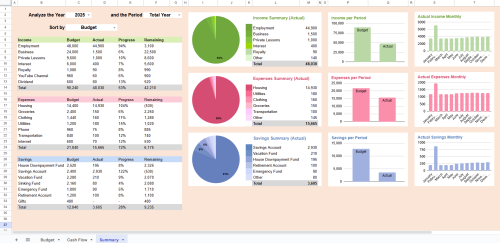

The Personal Budget Planner is a digital budgeting tool designed to work within Google Sheets. Unlike traditional budgeting methods, this planner offers a dynamic and interactive approach to managing your finances. Created with the intent to empower users to gain control over their money, it promises to go beyond simple tracking by providing insights and visualizations of your financial situation. The planner focuses on smart income allocation, automated insights, and an interactive dashboard to help you understand your spending habits and make informed decisions.

What You Get Inside Personal Budget Planner

When you purchase the Personal Budget Planner, you receive a comprehensive PDF file that contains the link to download the planner itself. Here’s a breakdown of what you can expect:

- Smart Income Allocation: This feature allows you to plan and track how your income is distributed across various expense and savings categories.

- Automated Insights: The tool generates structured breakdowns of your budgeting performance for each month and year, making it easy to see where you stand financially.

- Interactive Summary Dashboard: This dashboard visualizes your financial trends, providing instant feedback on your budgeting efforts.

- Full History & Analysis: Store and review past months and years with just three dynamic spreadsheets, allowing you to analyze your financial patterns over time.

- Easy to Use & Customizable: The planner is designed for simplicity and flexibility, enabling you to adapt it to your personal budgeting needs effortlessly.

Is Personal Budget Planner a Scam or Legit?

This is a valid concern, especially given the number of overhyped products in the budgeting space. However, I found several indicators that suggest the Personal Budget Planner is a legitimate product. The creator provides transparency about the tool’s features and functionality, and the training structure appears clear and organized. Additionally, the claims made about the planner seem realistic and achievable, especially considering its focus on user-friendly design. While some may find the marketing language a bit enthusiastic, the core features seem to deliver value without the usual hype.

Benefits & Advantages

- Empowers financial decision-making: Helps you make smarter choices with your money.

- Visualize your financial health: Instant insights through an interactive dashboard.

- Customizable and user-friendly: Fits your unique budgeting style and needs.

- Track historical data: Analyze your financial trends over time easily.

- Automated insights: Saves time and effort in tracking your finances.

Pros & Cons

| Pros | Cons |

|---|---|

| Dynamic and interactive budgeting tool | Requires familiarity with Google Sheets |

| Automated insights save time | Initial setup may take some time |

| Customizable to fit personal needs | Not ideal for those who prefer pen-and-paper budgeting |

| Clear visual representation of finances | Dependent on technology and internet access |

Analysis of Pros and Cons

In real-life application, the pros of the Personal Budget Planner stand out significantly. Its dynamic nature and automated insights can truly streamline your budgeting process, making it easier to manage your finances. On the other hand, the cons—like the need for familiarity with Google Sheets—may be minor annoyances for some users, but could be deal-breakers for those who are less tech-savvy. Overall, if you are willing to invest some time in learning the tool, the benefits can far outweigh the drawbacks.

Who Should Avoid Personal Budget Planner?

- Individuals who dislike digital tools and prefer traditional budgeting methods.

- Those who expect instant financial results without putting in the necessary effort.

- People who are overwhelmed by technology and prefer a straightforward, less interactive approach.

- Those who have no desire to analyze or review their financial history.

Who is Personal Budget Planner For?

The ideal user of the Personal Budget Planner is someone who is ready to take charge of their finances and is comfortable using digital tools. Here are a few profiles that fit this description:

- Busy professionals: Those juggling work and personal life who need a quick yet effective way to manage their finances.

- Students or recent graduates: Individuals looking to establish good budgeting habits early in their financial journey.

- Families: Households wanting a clear overview of their income and expenses to save for future goals.

However, if you are someone who prefers a hands-off approach to budgeting or finds technology daunting, you might be better off exploring simpler, more traditional budgeting methods.

Educational Section: Practical Tips for Budgeting

1. Track Your Expenses

Start by keeping a detailed record of your daily expenses. This will help you identify where your money goes and highlight areas where you can cut back. The Personal Budget Planner can simplify this process with its automated insights.

2. Set Clear Financial Goals

Having specific financial goals can motivate you to stick to your budget. Whether it’s saving for a vacation or paying off debt, clear goals help keep your spending in check.

3. Review Monthly

Make it a habit to review your budget monthly. Checking in on your progress can reveal trends and help you adjust your spending accordingly. The planner’s interactive dashboard is designed for this purpose, providing a quick overview of your financial health.

4. Use Budgeting Apps

If spreadsheets aren’t your thing, consider using budgeting apps that sync with your bank account. Regardless of your choice, having a system in place will enhance your financial awareness.

5. Consult a Financial Advisor

If you’re unsure about your financial situation or how to proceed, seeking advice from a financial professional can provide personalized guidance tailored to your needs.

Myths vs Reality

It’s common to encounter myths about budgeting tools that can create unrealistic expectations. Here are a few:

- Myth: Budgeting is a one-time task.

- Reality: Budgeting requires ongoing effort and adjustments. The Personal Budget Planner helps facilitate this through its dynamic features.

- Myth: You can set it and forget it.

- Reality: Regular reviews are essential. The planner encourages you to check your financial performance regularly.

Understanding these myths can help you approach budgeting with realistic expectations, making the Personal Budget Planner a more effective tool in your financial journey.

Guarantee, Refunds & Your Risk

The Personal Budget Planner comes with a satisfaction guarantee, allowing you to test the product and determine if it meets your needs. If you find that it doesn’t suit your budgeting style, you can request a refund within a specified period. This low-risk option means you can explore the planner’s features without worrying about losing your money. You can go through the modules and see how well it integrates into your daily financial management.

FAQs

Who is Personal Budget Planner for?

The planner is designed for anyone looking to gain control over their finances, from busy professionals to families managing household budgets.

How long does it take to see results?

Results can vary based on your commitment to using the planner regularly. Many users notice improvements in their budgeting habits within a few weeks.

What if I am a beginner?

No worries! The planner is user-friendly and customizable, making it suitable for beginners. There are also tutorials available to help you get started.

How do I use the product correctly?

Simply download the planner from the provided link, open it in Google Sheets, and start inputting your financial data. Regularly review and adjust as needed.

What happens if I request a refund?

If you find the product doesn’t meet your expectations, you can request a refund within the specified period. This allows you to try it risk-free.

Conclusion

In summary, the Personal Budget Planner offers a structured approach to managing your finances, making it a valuable tool for those struggling with budgeting. By utilizing this planner, you can gain clarity on your financial situation and make informed decisions about your spending and savings. However, be prepared to invest time and effort into learning how to use it effectively. If you’re still unsure, remember that the satisfaction guarantee allows you to test it out risk-free.

Verdict

The Personal Budget Planner is best suited for individuals ready to take their budgeting seriously and who are comfortable using digital tools. If you’re someone who prefers a more traditional approach or expects instant results without effort, you may find this product disappointing. Overall, I recommend giving it a try, especially since the satisfaction guarantee allows you to explore its features without financial risk.